Speculation Forward Contract . future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge against risks or. By taking positions in forward. a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. They aren't interested in buying or. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. futures and forwards are contractual agreements employed by companies and investors for purposes. speculators can use forward contracts to manage their risk exposure to certain assets or markets. meaning of speculation. Speculators try to maximize their profits by 'betting' on which way the prices will go.

from www.slideserve.com

By taking positions in forward. They aren't interested in buying or. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge against risks or. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. speculators can use forward contracts to manage their risk exposure to certain assets or markets. a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. meaning of speculation. Speculators try to maximize their profits by 'betting' on which way the prices will go. futures and forwards are contractual agreements employed by companies and investors for purposes. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a.

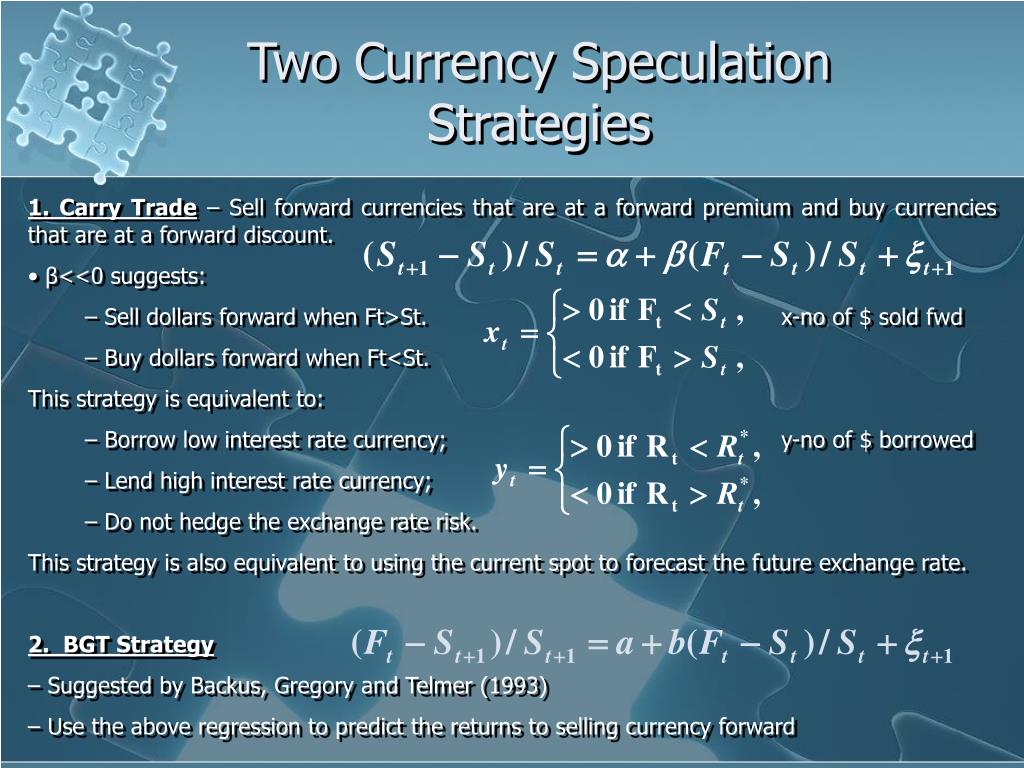

PPT Forward Premium Puzzle Futures Contracts Evidence and

Speculation Forward Contract forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge against risks or. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. speculators can use forward contracts to manage their risk exposure to certain assets or markets. a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. By taking positions in forward. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. Speculators try to maximize their profits by 'betting' on which way the prices will go. futures and forwards are contractual agreements employed by companies and investors for purposes. They aren't interested in buying or. meaning of speculation.

From slideplayer.com

International Business Environments & Operations ppt download Speculation Forward Contract a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge against risks or. forward contracts are typically used to hedge prices of commodities or currency interest rates by large. Speculation Forward Contract.

From www.slideserve.com

PPT SET OFF & CARRY FORWARD OF LOSSES PowerPoint Presentation ID Speculation Forward Contract meaning of speculation. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. They aren't interested in buying or. futures and forwards are contractual agreements employed by companies and investors for purposes. speculators can use forward contracts to manage their. Speculation Forward Contract.

From treasuryxl.com

Types of Forward Contract Speculation Forward Contract forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. speculators can use forward contracts to manage their risk exposure to certain assets or markets. They aren't interested in buying or. By taking positions in forward. future and forward contracts (more commonly referred to as futures and forwards). Speculation Forward Contract.

From finance.gov.capital

How can Forward Contracts be used for speculation in the commodity Speculation Forward Contract futures and forwards are contractual agreements employed by companies and investors for purposes. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. speculators can use forward contracts to manage their risk exposure to certain assets or markets. future and. Speculation Forward Contract.

From tradebrains.in

What are Forward Contracts? And How do they work!! Trade Brains Speculation Forward Contract meaning of speculation. futures and forwards are contractual agreements employed by companies and investors for purposes. speculators can use forward contracts to manage their risk exposure to certain assets or markets. By taking positions in forward. They aren't interested in buying or. a forward contract is a private agreement between two parties to buy or sell. Speculation Forward Contract.

From www.slideserve.com

PPT Forward Premium Puzzle Futures Contracts Evidence and Speculation Forward Contract speculators can use forward contracts to manage their risk exposure to certain assets or markets. futures and forwards are contractual agreements employed by companies and investors for purposes. meaning of speculation. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. a forward contract is a. Speculation Forward Contract.

From www.youtube.com

FORWARD CONTRACT Speculation and Firm Commitment Trim YouTube Speculation Forward Contract a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. futures and forwards are contractual agreements employed by companies and investors for purposes. a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. future and. Speculation Forward Contract.

From fintrakk.com

Forward Contracts Meaning, Examples and Types of Settlement Fintrakk Speculation Forward Contract By taking positions in forward. They aren't interested in buying or. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge against risks or. Speculators try to maximize their profits by 'betting' on which way the prices will go. a forward contract is a private. Speculation Forward Contract.

From www.slideserve.com

PPT Forward Premium Puzzle Futures Contracts Evidence and Speculation Forward Contract forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. meaning of speculation. futures and forwards are contractual agreements employed by companies and investors for purposes. a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. speculators can use forward contracts. Speculation Forward Contract.

From www.youtube.com

Topic 16 Forward contracts and Accounting for Hedges YouTube Speculation Forward Contract forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. futures and forwards are contractual agreements employed by companies and investors for purposes. By taking positions in forward. a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. speculators can use forward. Speculation Forward Contract.

From analystprep.com

Forward Contract AnalystPrep CFA® Exam Study Notes Speculation Forward Contract a forward contract is a customized derivative contract obligating counterparties to buy (receive) or sell. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. speculators can use forward contracts to manage their risk exposure to certain assets or markets. future and forward contracts (more commonly referred. Speculation Forward Contract.

From www.slideserve.com

PPT Derivatives MarketTypes of Traders PowerPoint Presentation, free Speculation Forward Contract By taking positions in forward. Speculators try to maximize their profits by 'betting' on which way the prices will go. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. They aren't interested in buying or. meaning of speculation. a forward contract is a customized derivative contract obligating. Speculation Forward Contract.

From walletinvestor.com

How can forward contracts be used for speculation? WalletInvestor Speculation Forward Contract speculators can use forward contracts to manage their risk exposure to certain assets or markets. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are. Speculation Forward Contract.

From analystprep.com

Forward Contract AnalystPrep CFA® Exam Study Notes Speculation Forward Contract Speculators try to maximize their profits by 'betting' on which way the prices will go. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. speculators can use forward contracts to manage their risk exposure to certain assets or markets. a forward contract is a customized derivative contract. Speculation Forward Contract.

From hspaproposalhorse.pages.dev

Forward Contract How To Use It Risks And Example Forward And Future Speculation Forward Contract speculators can use forward contracts to manage their risk exposure to certain assets or markets. forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge. Speculation Forward Contract.

From www.slideserve.com

PPT Foreign Currency Concepts and Transactions PowerPoint Speculation Forward Contract forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial. futures and forwards are contractual agreements employed by companies and investors for purposes. speculators can use forward contracts to manage their risk exposure to certain assets or markets. meaning of speculation. a forward contract is a. Speculation Forward Contract.

From www.slideserve.com

PPT Forward Premium Puzzle Futures Contracts Evidence and Speculation Forward Contract speculators can use forward contracts to manage their risk exposure to certain assets or markets. a forward contract is a private agreement between two parties to buy or sell an asset, in this case currency, at a specified price on a. Speculators try to maximize their profits by 'betting' on which way the prices will go. a. Speculation Forward Contract.

From www.slideserve.com

PPT Forward Premium Puzzle Futures Contracts Evidence and Speculation Forward Contract By taking positions in forward. future and forward contracts (more commonly referred to as futures and forwards) are contracts that are used by businesses and investors to hedge against risks or. Speculators try to maximize their profits by 'betting' on which way the prices will go. meaning of speculation. futures and forwards are contractual agreements employed by. Speculation Forward Contract.